Not Getting Lost

Sometime around the 4th and 5th century BC, the Roman army needed a reliable way to move its legions from one city to the next without getting bogged down in the soggy terra firma. To facilitate this, Roman engineers began to design and build roads made of stone and concrete, a process that introduced camber, embankments and grade. One of the most famous of these roads was Via Appia, which can still be seen today. During construction, it became clear to the engineers that they needed a uniform way to gauge the distance between various parts of the Roman Empire along these roads.

The Romans determined that a fixed marker should be placed at “mille passuum”, or 1,000 paces. On that marker they wrote the number of “mille passuum” to and from the next major landmark (usually a city or town), as well as the distance from the Roman Forum. These markers were made of stone, which is the origin of the word “milestone.”

Today, we use that term to note special moments or achievements along a continuum of time. Parents use it to mark the events of their children’s growth. Some companies structure their sales contracts to receive certain payments when specific deliverables are achieved, and they call these “milestone payments.” Venture capitalists use the term to define goals that get a young company its next round of funding. At Pacific Ridge, we reached a significant milestone in our own history. Our firm is now three years old. Although our staff has worked together in other companies for over 15 years, Pacific Ridge has passed a milestone of longevity in our industry. For our clients who have been with us on this three-year journey, they have been richly rewarded.

Milestones were extremely important for the Roman army when they entered “terra incognita,” or unknown lands. Whenever a Roman Cohort pushed into foreign territory, they would erect new milestones and they didn’t skip. It was crucial to put some kind of marker—even a tree branch stuck in the mud—to indicate 1,000 paces and the direction to the previous marker. By doing this, the Roman army could measure its forward progress by looking back and seeing from whence it came. Experienced officers who had a familiarity with local terrains were invaluable during this time, as maps were still crude drawings, not to scale, and sometimes completely wrong. Additionally, though celestial navigation could be used, magnetic compasses were still several hundred years away. There was no substitute for a seasoned officer with local knowledge and the discipline to mark his tracks. Losing your way in foreign lands likely meant an early death.

Investing is no different. There is no substitute for experience. Experience only comes with the passage of time. We have an appreciation for history because it provides context to the current market conditions. Some observers act as if the present world economy and stock market gyrations are themselves “terra incognita.” However, that is just not the case. Conditions like ours—low growth, low interest rates, and higher equity valuations—have repeated themselves several times over the long history of the US markets, not to mention the longer history of worldwide markets. The ability to place the current conditions into context should yield good results for the patient investor. Part of that confidence comes from paying attention to the milestones of the past and being disciplined enough to remain calm when everyone else is in a panic.

During the next three years, we expect that one of the most important factors affecting the stock market will be the phaseout of “accommodating” monetary policies in the United States. As this happens, a tremendous amount of capital will be lost on poorly financed projects and speculative bubbles. That upheaval, however, should present some very attractive opportunities for our clients and for us.

We look forward to our next milestone and to the opportunities that will present themselves over the coming years.

Sincerely,

Pacific Ridge Capital Partners

About Pacific Ridge Capital Partners

Pacific Ridge Capital Partners is an employee-owned firm. We generate our own investment ideas using fundamental analysis and bottom-up stock picking. The investment team applies a consistent, patient and disciplined process that results in low turnover and stability. Our proven philosophy has performed well over many investment cycles and it is the consistent application of this strategy that makes Pacific Ridge unique.

The principals of Pacific Ridge Capital Partners are invested along with our clients in each of our strategies.

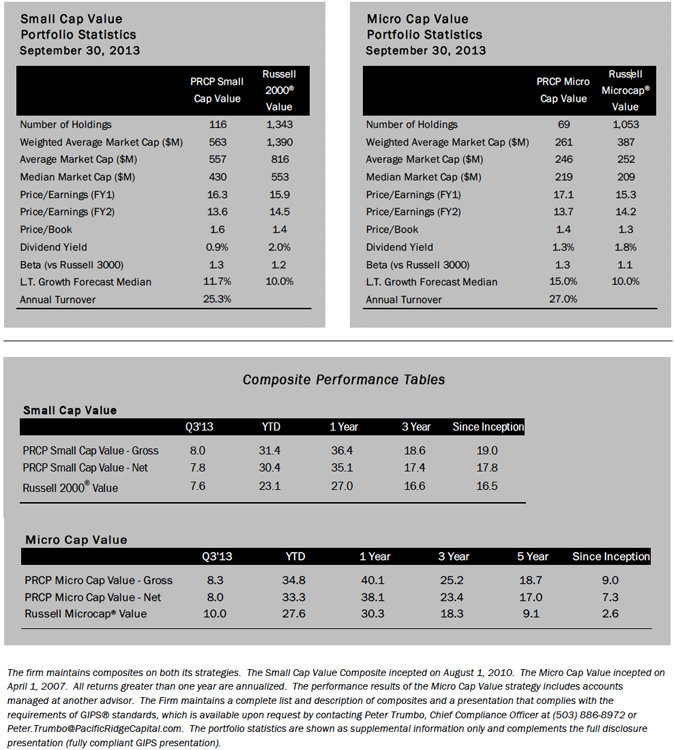

PRCP Small Cap Value – Our Small Cap Value strategy generally purchases stocks in the bottom three-quarters of the Russell 2000® Index. This smaller capitalization segment has a large number of underfollowed companies, providing us the greatest opportunity to exploit market inefficiencies. The typical range of holdings is between 100 and 150.

PRCP Micro Cap Value – Our Micro Cap Value strategy generally purchases stocks in the Russell Microcap® Index. This segment is widely underfollowed, providing us the greatest opportunity to exploit market inefficiencies. The typical range of holdings is between 50 and 80.

We believe these market cap segments offer great potential returns and additional diversification for our clients. For further information about Pacific Ridge Capital Partners and our investment strat- egies, we invite you to contact Tammy Wood via email at Tammy.Wood@PacificRidgeCapital or by phone at (503) 878-8502.

Disclosures

Pacific Ridge Capital Partners, LLC (“Pacific Ridge”, “PRCP”, or “the Firm”) is an employee-owned investment advisor registered with the Securities and Exchange Commission under the Investment Advisor Act of 1940. The Firm was established in June 2010, and has one office located in Lake Oswego, Oregon. Pacific Ridge claims compliance with the Global Investment Performance Standards (GIPS®).

Sources: Pacific Ridge; FactSet Research Systems (“FactSet”); and Russell Investment Group (“Russell”) who is the source and owner of the Russell Index data.

The current annual investment advisory fees for the portfolios managed in the Firm’s Small and Micro Cap Value strategies are 1.00% and 1.50% of assets, respectively. Returns for the composites are presented gross and net of management fees and other expenses and includes realized and unrealized gains and losses, cash and cash equivalents and related interest income, and accrued based dividends. The Firm calculates time weighted rates of return by geometrically linking portfolio simple rates of return at least monthly, with adjustments made for significant external cash flows. The composite returns are calculated by asset weighting the individual portfolio returns using beginning of the period values. All returns are calculated after the deduction of the actual trading expenses incurred during the period.

The information provided should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in our strategy at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the holdings discussed herein were or will be profitable or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. Past performance is no guarantee of future results.

Although the statements of fact and data in this report have been obtained from, and are based upon, sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the Firm’s judgment as of the date of this report and are subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

The Russell 2000® Value Index measures the performance of the Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. For comparison purposes, the index is fully invested, which includes the reinvestment of income. The return for the index does not include any transaction costs, management fees or other costs.

The Russell Microcap® Value Index measures the performance of the microcap segment of the U.S. equity market. For comparison purposes, the index is fully invested, which includes the reinvestment of income. The return for the index does not include any transaction costs, management fees or other costs.

Returns and asset values are stated in US dollars.