Market Works

Oil is on everyone’s mind these days, and its rapid drop in price has repercussions that will significantly affect the economy and stock market. That is why we’d like to start this quarter’s commentary with a discussion of this very important topic.

During the last seven months, the price of oil has dropped nearly 60%, from over $100 per barrel to just around $45 per barrel at the beginning of February. This is a classic example of the law of supply and demand, and is very informative for investors. Here’s the basic economic pattern: Increase the supply of a good in excess of demand and its price should go down. Certainly, this has been the case with oil. According to the US Energy Information Administration (EIA), approximately 93.7 million barrels of oil (MBO) per day were produced worldwide between July 2014 and January 2015. During that same period, demand for oil averaged 92.9 MBO per day. That nets out to an excess supply of 175 million barrels of oil over the seven month period. Since the end of January, the EIA reports that supply is still outpacing demand to the tune of 1 MBO per day. Because supply exceeds demand, the price should move to a level that begins to clear the market.

If you are an oil producer (or the shareholder of one), your economic well-being is much different at $100 per barrel than it is at $45 per barrel. In fact, if your marginal cost to produce is above $45, you better fold up shop. And that is exactly what is happening in the United States.

US rig counts have dropped 30% this year in very rapid fashion—mostly in the last two months. That means fewer operating rigs, and therefore less oil that will be pumped.

In time, this reduction in supply (borne mostly by the US), should allow prices to gradually rise. And rise they will, but only to a point. Saudi Arabia has stated that it will now be a price taker in this market, not a price maker. Over time, as players fall away, Saudi Arabia will once again garner a larger and more important share of the market. It’s what market leaders have always done when their back is against the wall: Lay siege to the enemy and see who can hold out the longest. Whether Saudi Arabia again takes a prominent price-making position remains to be seen.

While there are several theories about why Saudi Arabia is flexing its muscles, it is not our intention to discuss those issues in this commentary. Rather, we want to illustrate that investors (including ourselves) are still trying to figure out how much of the price collapse is supply driven (not necessarily bad for the world economy), and how much is demand driven (a bad leading indicator). Once the excess supply is run out of the market, we should start to see prices rise, with additional increases on the way if there is any meaningful increase in demand. For that matter, most energy market observers are pegging worldwide demand to continue to grow better than 1% in the coming year, with even higher consumption patterns looming.

We predict that oil will likely settle at a price just below the marginal cost of production for US shale-based oil production. The Saudis have no interest in letting more players in the market, so we’re not likely to see $100 oil for some period of time. That said, we’re also not likely to see $45 oil last for much longer unless there is a collapse in demand.

The price of oil is going to have an impact on monetary decisions from the Fed over the next few years. When we add up the numbers, the capital spending cutbacks and wage reduction initiatives we are seeing will likely to put a clamp on wage pressure this year and will probably notch down inflation figures and potentially clip GDP growth in the US. As such, Fed moves to tighten are likely a bit further out than we thought even a few months ago. Any rise in short-term rates will also likely strengthen the dollar in the face of a sluggish Europe. Could we be heading to a flat or inverted yield curve?

We continue to spend this early part of the year assessing the health of the companies in our portfolios, both in terms of their current results and what we expect their long term outcomes to be. While the aggregate valuations are extended, we see no shortage of very good companies selling a low prices.

Sincerely,

Pacific Ridge Capital Partners

About Pacific Ridge Capital Partners

Pacific Ridge Capital Partners is an employee-owned firm. We generate our own investment ideas using fundamental analysis and bottom-up stock picking. The investment team applies a consistent, patient and disciplined process that results in low turnover and stability. Our proven philosophy has performed well over many investment cycles and it is the consistent application of this strategy that makes Pacific Ridge unique.

The principals of Pacific Ridge Capital Partners are invested along with our clients in each of our strategies.

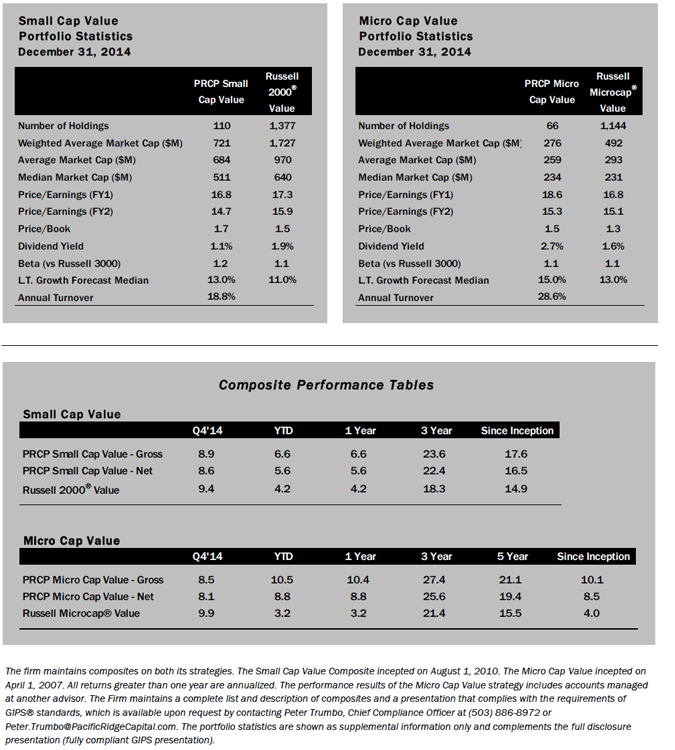

PRCP Small Cap Value – Our Small Cap Value strategy generally purchases stocks in the bottom three-quarters of the Russell 2000® Index. This smaller capitalization segment has a large number of underfollowed companies, providing us the greatest opportunity to exploit market inefficiencies. The typical range of holdings is between 100 and 150.

PRCP Micro Cap Value – Our Micro Cap Value strategy generally purchases stocks in the Russell Microcap® Index. This segment is widely underfollowed, providing us the greatest opportunity to exploit market inefficiencies. The typical range of holdings is between 50 and 80.

We believe these market cap segments offer great potential returns and additional diversification for our clients. For further information about Pacific Ridge Capital Partners and our investment strat- egies, we invite you to contact Tammy Wood via email at Tammy.Wood@PacificRidgeCapital.com or by phone at (503) 878-8502.

About Pacific Ridge Capital Partners

Pacific Ridge Capital Partners is an employee-owned firm. We generate our own investment ideas using fundamental analysis and bottom-up stock picking. The investment team applies a consistent, patient and disciplined process that results in low turnover and stability. Our proven philosophy has performed well over many investment cycles and it is the consistent application of this strategy that makes Pacific Ridge unique.

The principals of Pacific Ridge Capital Partners are invested along with our clients in each of our strategies.

PRCP Small Cap Value – Our Small Cap Value strategy generally purchases stocks in the bottom three-quarters of the Russell 2000® Index. This smaller capitalization segment has a large number of underfollowed companies, providing us the greatest opportunity to exploit market inefficiencies. The typical range of holdings is between 100 and 150.

PRCP Micro Cap Value – Our Micro Cap Value strategy generally purchases stocks in the Russell Microcap® Index. This segment is widely underfollowed, providing us the greatest opportunity to exploit market inefficiencies. The typical range of holdings is between 50 and 80.

We believe these market cap segments offer great potential returns and additional diversification for our clients. For further information about Pacific Ridge Capital Partners and our investment strat- egies, we invite you to contact Tammy Wood via email at Tammy.Wood@PacificRidgeCapital.com or by phone at (503) 878-8502.

Disclosures

Pacific Ridge Capital Partners, LLC (“Pacific Ridge”, “PRCP”, or “the Firm”) is an employee-owned investment advisor registered with the Securities and Exchange Commission under the Investment Advisor Act of 1940. The Firm was established in June 2010, and has one office located in Lake Oswego, Oregon. Pacific Ridge claims compliance with the Global Investment Performance Standards (GIPS®).

Sources: Pacific Ridge; FactSet Research Systems (“FactSet”); and Russell Investment Group (“Russell”) who is the source and owner of the Russell Index data.

The current annual investment advisory fees for the portfolios managed in the Firm’s Small and Micro Cap Value strategies are 1.00% and 1.50% of assets, respectively. Returns for the composites are presented gross and net of management fees and other expenses and includes realized and unrealized gains and losses, cash and cash equivalents and related interest income, and accrued based dividends. The Firm calculates time weighted rates of return by geometrically linking portfolio simple rates of return at least monthly, with adjustments made for significant external cash flows. The composite returns are calculated by asset weighting the individual portfolio returns using beginning of the period values. All returns are calculated after the deduction of the actual trading expenses incurred during the period.

The information provided should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in our strategy at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the holdings discussed herein were or will be profitable or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. Past performance is no guarantee of future results.

Although the statements of fact and data in this report have been obtained from, and are based upon, sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the Firm’s judgment as of the date of this report and are subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

The Russell 2000® Value Index measures the performance of the Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. For comparison purposes, the index is fully invested, which includes the reinvestment of income. The return for the index does not include any transaction costs, management fees or other costs.

The Russell Microcap® Value Index measures the performance of the microcap segment of the U.S. equity market. For comparison purposes, the index is fully invested, which includes the reinvestment of income. The return for the index does not include any transaction costs, management fees or other costs.

Returns and asset values are stated in US dollars.