Interesting Times in the Market

November 2025

“Interesting times in the market” is an overused phrase. Especially in the smallest portion of the US equity markets where we have spent our entire careers, it is “par for the course” to a large degree. Perhaps “never a dull moment” is more fitting.

However, 2025 has undeniably been a VERY interesting year at the intersection of macroeconomics, politics, trade policy, technology and markets. We were visiting clients in our nation’s capital on April 3rd, the day after “liberation day” (and just a day after publishing our most recent commentary, ironically in retrospect, titled “Looking Back on Big Market Moves”). Who would have believed that within days there would be a market bottom followed by a significant market rally that certainly defied the old market adage: “sell in May and go away”? Then we were back in DC seeing some of the same folks on October 1st, for the kickoff of the still-ongoing government shutdown. We fear we may not be invited back!

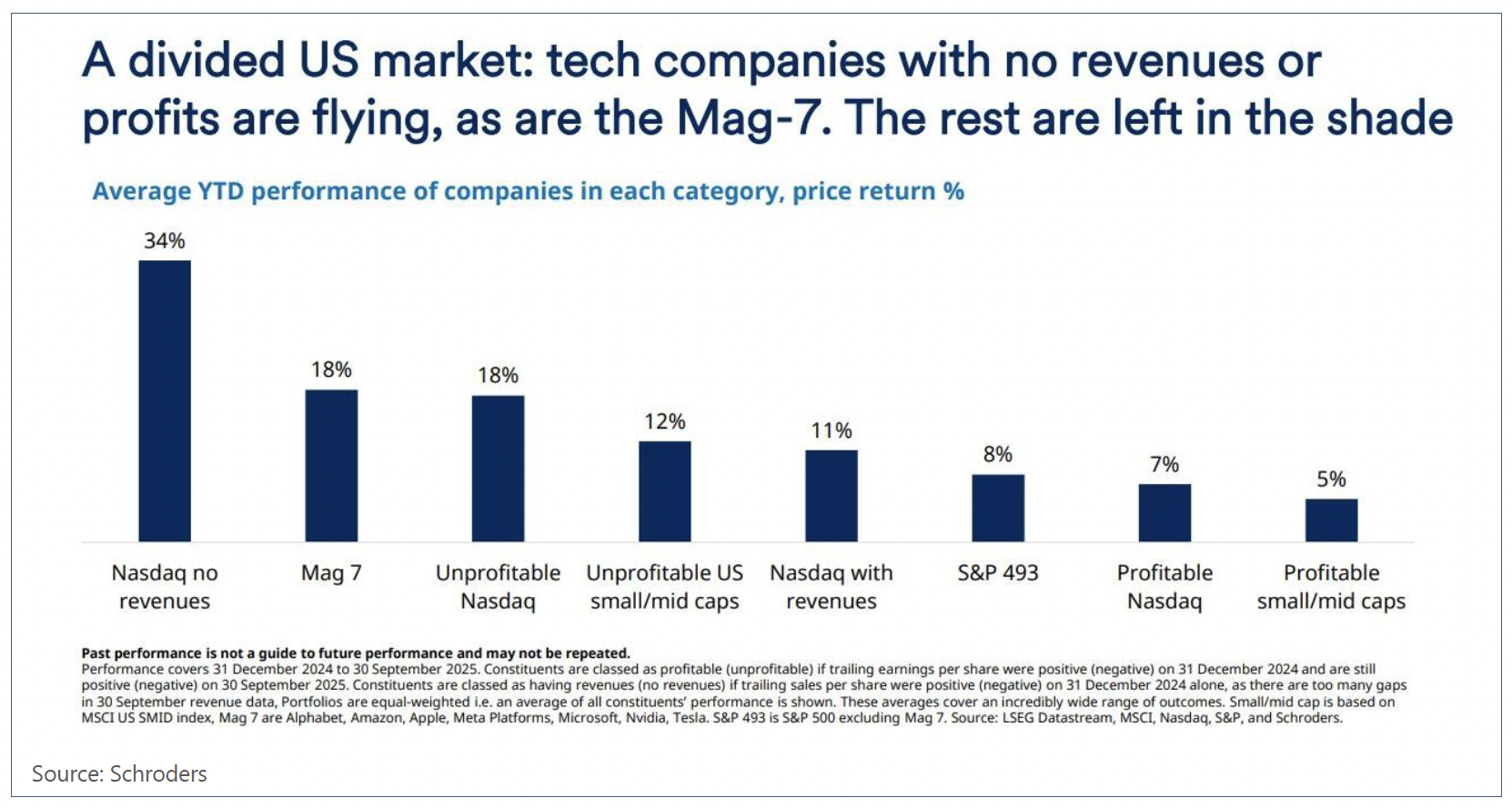

By now we think it is well understood, in the financial press and maybe more broadly, that the 2025 rally has been at least a(nother) “growth rally”, and perhaps better termed a “low quality rally.” A number of charts have been making the rounds to explain this phenomenon, but here is just one example we recently saw on X (credit: Schroders), and we think it speaks for itself (data for year-to-date through September 30):

Despite the continued strong performance of the “Mag 7”, we were somewhat heartened during the summer by what appeared to be a broadening of the market. At least as measured not only by small cap outperformance of larger stocks in the third quarter, but even more so by micro-cap stocks.

But then came mid-September and a switch seemed to get flipped. It coincided with the much-anticipated and well-predicted first Federal Reserve rate cut, but we think the timing of that is either somewhat or largely coincidental.

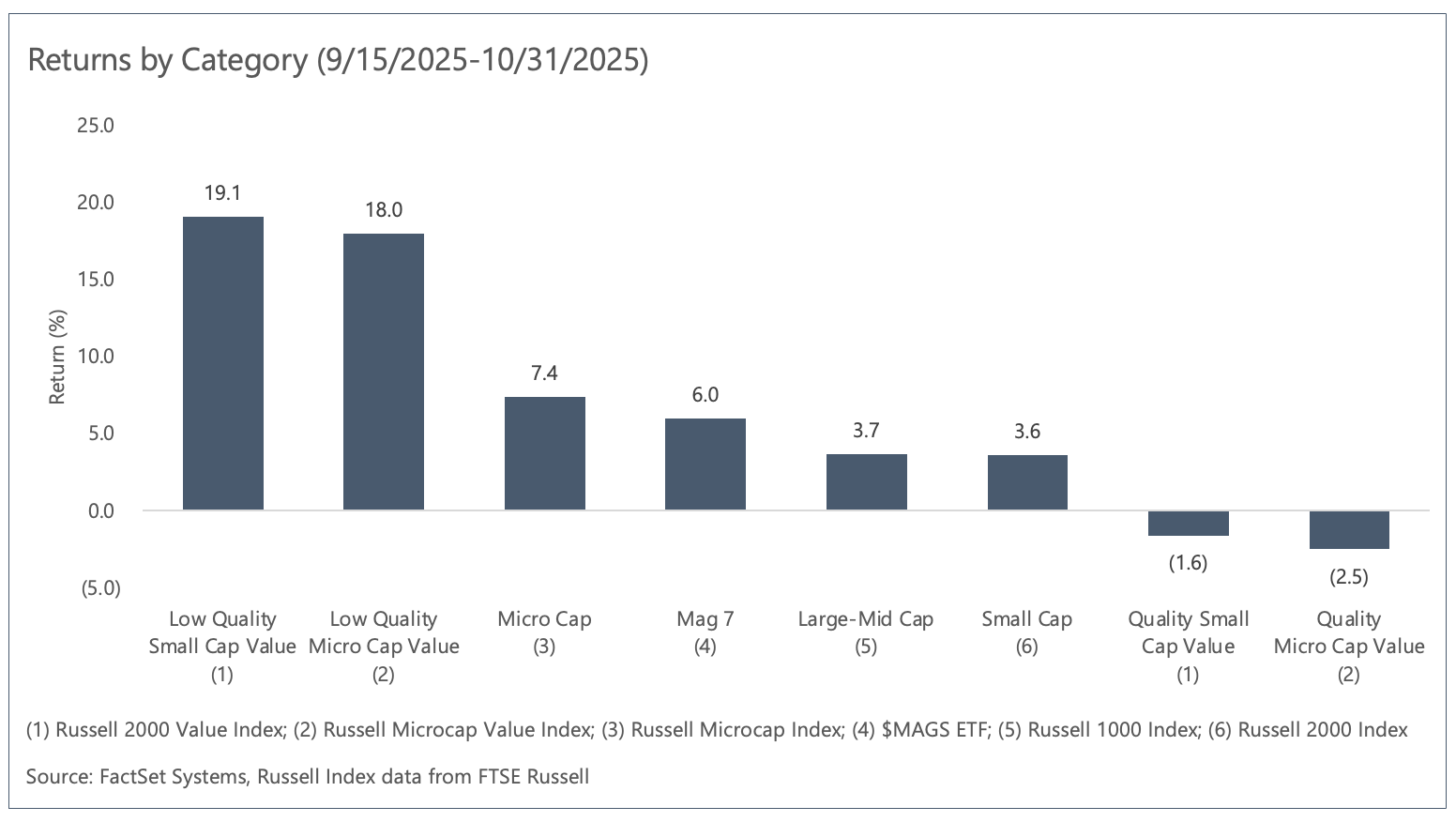

Since that time, especially in our small/micro-cap corner of the markets, we have seen craziness that is perhaps only equaled in recent memory by the meme stock craze of early 2021. This time, simply put, the grand majority of the returns in the universe since then have come from companies that are wildly unprofitable, if not pre/early-stage revenue. Lest one think we are exaggerating, here’s our rundown of the situation (data from FactSet Systems):

As seen in the middle four bars, there has not been a significant difference in the performance of US equities based on size. Other than a bit of continued strength in the Mag 7 stocks, and then notably some microcap leadership. Good for us? Might have been, if not for those two pesky bars on each side, with the bars on the left entirely explaining the façade of microcap leadership.

We define “low quality” (even within the Russell “value” indexes) as stocks WELL outside of our typical definition of value. Specifically, just to take it to the extreme, our definition is companies with one or more of the following: a) less than $5 million in annual revenue (tiny pre- or early-stage revenue); b) worse than -25% EBITDA profit margins (not just unprofitable, but highly unprofitable); and c) a total enterprise value to revenue multiple of 20x or higher (extreme valuations). As a fallout, we simply call everything else “quality”, even though many would never pass muster through our investment process (given our thoughts on Quality).

If those returns don’t pop off the page enough, here is another way we would describe the current environment. We looked at the 40 top-returning (unweighted) stocks in the Russell Microcap Value benchmark from September 15 to October 31. Those stocks had returns ranging from 65% on the low end up to well over 100% (for >10 stocks), compared to the other nearly 1000 stocks in the index that had a straight average return of -0.4%. While disparity of returns exist in any period, what really stands out to us is that only two or three of the top 40 performers would have ever been considered as an investment in our portfolios, even before their big moves. Twenty seven of the 40 have no revenue or revenue so low that their revenue multiples exceed 50x, and a similar number (with a significant but not total overlap) are biotechnology companies.

So, what is behind these returns and what are the implications going forward? Well, those are the million-dollar questions, and without certain answers.

We do not believe that the well-anticipated Fed rate cut helped fuel the speculation, besides maybe as a justification for making future financing of unprofitable biotechs potentially more attractive. Other potential answers include biotech optimism tied to some nice buyout premiums and notable clinical trial successes. But it hasn’t been only biotechs. There was AI enthusiasm tied to ongoing elevated capital investment, buoyed to some degree by investment and purchase agreements among major industry players, and speculation in companies in the “rare earths” space triggered by US federal government investments in two such companies. Further, there was some meme-stock-like activity in some heavily shorted stocks, Beyond Meat being one noteworthy example, as well as other speculation in areas such as crypto and nuclear energy.

As noisy and potentially distracting as times like these can be, our team has navigated through similar situations before. The most recent notable example being the aforementioned meme stock and GameStop craze of early 2021. As is always the case, we stick to our knitting. Spending our days scouring the small- and micro-cap universes for misunderstood and unloved companies trading at attractive valuations, that has always been the bedrock of our ability to add value over full market cycles and the long-term. When these situations arise, they typically set up well for forward performance. While we can’t predict the timing or magnitude, the most recent example (just as one example), noted above, has been followed by outperformance since then.

We don’t usually think, talk, or write commentaries about performance over such short time periods, given the type of long-horizon investment that is our trade. But we’ve understandably had questions from clients about what’s been going on of late, so we wanted to share our best understanding of the situation.

This has not been the first period like this we have experienced, and of course it won’t be the last. We continue our steadfast pursuit of adding value for our clients via our patient long-term, time-tested investment approach.

As always, we welcome your questions and look forward to ongoing conversations with you.

The Pacific Ridge Investment Team